Bruw's Journey from Shark Tank to Acquisition: A Case Study

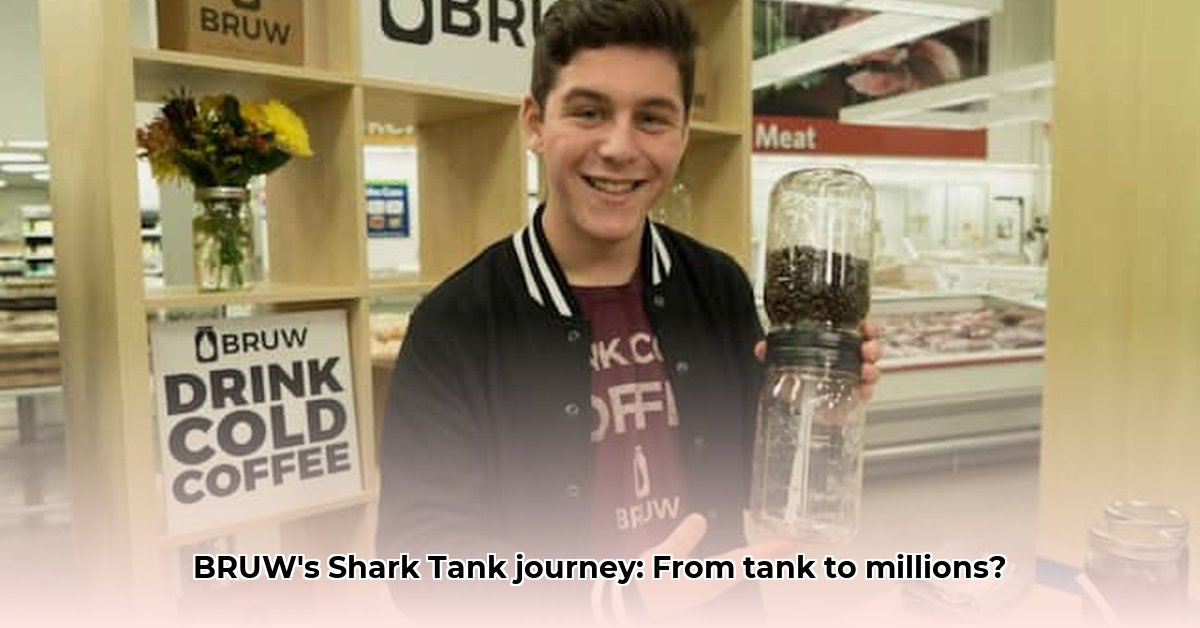

BRUW, Max Feber's innovative cold-brew coffee filter system, gained significant traction after its appearance on Shark Tank. Securing a $50,000 investment from Mark Cuban, BRUW reportedly generated a similar amount in revenue within the following year, demonstrating the immediate impact of the show's exposure. However, determining BRUW's current net worth requires a nuanced approach due to the limited public financial data available after its acquisition. For more on Shark Tank businesses, check out this net worth analysis.

From Shark Tank Investment to Acquisition: Unveiling the Success

BRUW's success wasn't solely reliant on initial sales; its strategic acquisition by Snarky Tea in 2020 played a crucial role. This acquisition signifies a strong validation of BRUW's business model and market fit. The precise financial details of the acquisition remain undisclosed, making a precise net worth calculation impossible. Nevertheless, the acquisition itself represents a considerable triumph for BRUW's founding team and investors.

Key Stakeholders and Their Potential Returns

Several stakeholders benefited from BRUW's trajectory. Max Feber, undoubtedly, gained financially and garnered invaluable entrepreneurial experience. Snarky Tea expanded its product line, potentially accessing new customer segments. Investors, including Mark Cuban, likely realized a return on their investment. While exact figures remain private, the acquisition suggests significant financial gains for all involved parties.

Assessing BRUW's Growth Trajectory: A Qualitative Analysis

Determining BRUW's exact net worth is hampered by the lack of publicly available financial data beyond its initial post-Shark Tank success. However, the available information points to considerable early success. The reported doubling of projected sales post-Shark Tank highlights BRUW's strong market potential. The subsequent acquisition by Snarky Tea further reinforces its viability, despite the lack of precise financial details. Therefore, success should be judged holistically: the acquisition itself marks a substantial achievement.

Future Outlook and Challenges for BRUW

Despite its acquisition, BRUW faces ongoing challenges and opportunities. Maintaining competitiveness in the saturated beverage market requires consistent innovation and new product development. Successfully integrating BRUW into Snarky Tea's existing operations is vital for long-term success; smooth transitions and efficient communication will be crucial. The scarcity of public financial information prevents a comprehensive assessment of BRUW's long-term financial health, but that shouldn’t diminish its remarkable achievements.

Stakeholder Perspectives: A Multifaceted View

The following table offers a perspective on the short-term and long-term prospects for key stakeholders:

| Stakeholder | Short-Term Outlook | Long-Term Outlook |

|---|---|---|

| Max Feber | Likely pursuing new ventures or entrepreneurial mentorship roles | Potential diversification into investments, consulting, etc. |

| Snarky Tea | Integrating BRUW operations, leveraging synergies across product lines | Expanding into new markets, developing complementary product categories |

| Investors | Monitoring Snarky Tea's performance and assessing their return on investment | Evaluating investment portfolios for future opportunities |

| Consumers | Continued access to a convenient cold-brew option | Growing demand for high-quality, readily accessible beverages |

Analyzing BRUW's Success: A Framework for Entrepreneurial Learning

BRUW's journey, while lacking in complete financial transparency, provides several valuable insights for aspiring entrepreneurs:

- Strategic Storytelling: BRUW effectively leveraged its Shark Tank appearance to build brand awareness and credibility.

- Rapid Scaling Challenges: Managing the rapid growth following its Shark Tank appearance showcased the complexities of scaling a young company.

- Successful Exit: The acquisition by Snarky Tea serves as a model for establishing a strategic exit strategy.

While the precise net worth remains elusive, BRUW's success highlights the significant potential of innovative products and the value of strategic partnerships. The company's story, although partially veiled, offers a compelling case study in entrepreneurial success.